With technological advancements in the automobile industry, the wheelchair van has become more accessible and reliable than ever before. While these vehicles have made wheelchair users’ lives easier, they also come with a hefty price tag. To help wheelchair users save on taxes, the government does offer a tax exemption for certain types of mobility equipment. Unfortunately, come tax season, it’s easy to get confused and end up paying more than the IRS requires, given the exemption you should be receiving. In this blog, we’ll explain how the handicap vehicle tax deduction works and how you can use it to your advantage.

Is There a Handicap Vehicle Tax Deduction?

Under IRS Publication 502, a taxpayer can deduct “the cost of special hand controls and other special equipment installed in a car for the use of a person with a disability.” This means, while the car itself is not tax deductible, the cost of modifying it for a wheelchair user can be claimed on your tax returns as an expense for medical care. However, there are some limitations to this rule. You can only deduct the amount that exceeds 7.5% of your adjusted gross income (AGI).

For instance, if you have an AGI of $50,000, then you can only claim a deduction that exceeds $3,750. It is important to note that you can only file this kind of claim by filling out form 1040 and applying for an itemized deduction on Schedule A of your tax return.

In addition to a tax deduction to help you save money, vehicle manufacturers like Honda, Toyota, and Chrysler may also offer a rebate of up to $1000 rebate if you purchase a new wheelchair-accessible van or modify an existing vehicle with adaptive equipment. Just make sure you keep the receipts for the equipment and installation for tax filing purposes.

Deductible Wheelchair-Accessible Adaptations

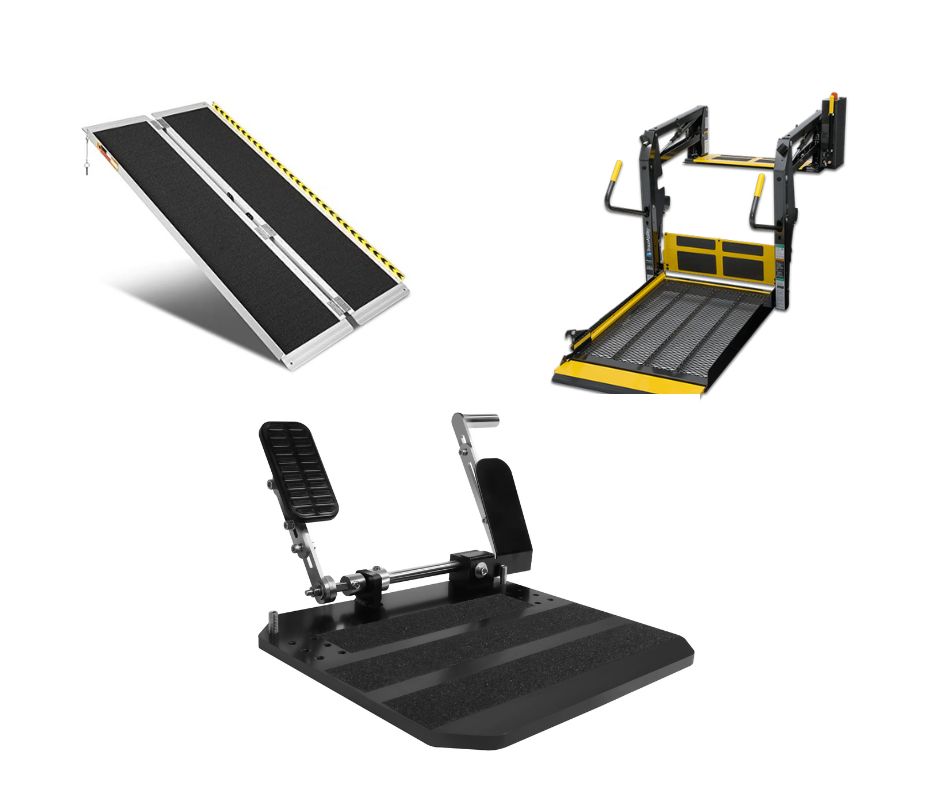

Now that you know that wheelchair-accessible conversions are eligible for tax deductions, you may be wondering which types of special equipment qualify. The IRS has approved the following items as tax deductibles:

- Electric hand controls

- Wheelchair lifts

- Ramps

- Left-side accelerator pedals

- Pedal and steering wheel extensions

- Raised roof

- Dropped floor

- Transfer seats

Can You Claim a Tax Deduction on Travel Expenses?

Yes, you can claim a tax deduction on travel expenses incurred using a mobility van. However, this also comes with certain limitations. For example, the wheelchair-accessible van must be used for a medical-related trip, which means that you must be traveling to see a specialist, visiting a hospital, or receiving treatment for an illness or injury in order for a deduction to apply. These kinds of trips are not deductible if they are for the general improvement of one’s health or a change of environment, even if it’s prescribed by the doctor.

You can also claim out-of-pocket costs of transportation, including tolls, parking fees, and gas and oil associated with doctor’s visits and appointments. The IRS also requires that you keep a log of all trips taken in your vehicle so that they can verify that it is being used for medical care. That means writing down things like the date, time, starting/ending mileage, and destination for each trip.

Frequently Asked Questions

Who is eligible for disability tax deductions for wheelchair-accessible vans?

Tax deductions for wheelchair-accessible vans and van adaptations can be claimed by whoever purchased the vehicle, including parents, guardians, spouses, or caregivers.

How do I claim a disability deduction on my tax return?

To claim the disability deduction, complete line 316 of Schedule 1 of your return and enter the amount at line 316 on Form T2201 – Disability Tax Credit Certificate. Attach a signed copy of your completed Form T2201 to your income tax return. If someone else is claiming on your behalf, then they claim it under line 318 of their tax return. As mentioned above, you also have to fill out form 1040 and itemize the deduction on Schedule A.

Is there a list of conditions that qualify for the disability tax deduction?

To be eligible for this deduction, you must have a severe and prolonged impairment in physical or mental functions, which can be expected to last for a continuous period of at least 12 months. The impairment must be medically determinable by a medical professional with relevant training and expertise.

Still Feeling Confused?

While tax deductions and credits can reduce the amount of income tax you owe in a given year, they can be quite tricky to navigate. And even if you have the right paperwork in place, don’t assume that your tax deductions will be accepted by the IRS without question. In fact, it’s not uncommon for individuals who make improper claims or fail to document their expenses properly to face penalties down the road.

To avoid any potential pitfalls, it’s important to consult an experienced tax attorney to make sure your tax deductions are legitimate. At Clock Mobility, our knowledgeable mobility consultants can also help you with the important documents you need to claim a tax deduction on wheelchair-accessible conversions or equipment that we install. Get in touch with us by calling (866) 380-3451 or visiting one of our Michigan showrooms.